Most business owners or managers can verify the importance of being involved at the local level. It was after the advice from a very insightful mentor that I decided to take the jump and join. My experience thus far has been positive and I have only seen benefit from my participation.

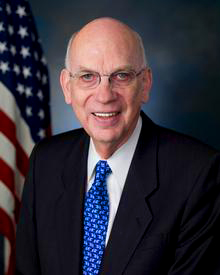

At a recent business chambers meeting I had the opportunity of Listening to Senator Bob Bennett. There were a lot of things said, (what else can we expect from a Senator?) But the format was pretty much a question and answer period.

I took the notes from my blackberry, so it’s a little condensed. But I still believe there are some interesting things there…

Senator Bob Bennett

Brief history of the electoral college. It was originally installed because the founding fathers thought the country was so large, no one person could be known by everyone, so a group of people were elected to nominate the top three candidates… Clearly outdated here in the information age, but still, we have it. Learn how to learn from it.

Q What can do for our part to help the nation heal more?

A We [Senators] say it a lot, “We want to Change. We want to Heal.” What you need to do is thoughfully write your reps. Please lower your voices. Let’s use less venom. Do not overwhelm the senate. –The recent bill for immigration is a perfect example of burning our the senate to prevent a real solution from being found. It got so bad that Senator Bennett was recieving death threats.

Q As a small business owner, I’m concerned about the national tax code. I’m in favor of a Fair Tax. Is it possible?

A Our tax code is perverse. Our taxes were developed under depressed and industrial cirmcumstances. We now live in an International economy in the information age. I believe Taxes should be to raise money to run government. Now decided government measure percentage of GDP

Ground rules change every 18 months. No one understands the code. Used to be 18.5 – 19.5 percent of GDP. Starting 2008 retied people will double. I would abolish payroll and income tax. We should go to a 20% of GDP rate. Consumption tax for 10 percent. Flat tax for other 10 percent. No more winners and losers. Q What does it take to make a difference?

A Senators are not bought and paid for. Money is given to people who already agree. Integrity now is higher than ever. Problems will be dealt. The question is when. Usually

Q Small business problems and some senators have backed down? Why?

A some times honorbound prevents somethings from happening. Things hurt. Wounds take time to heal. Just look at the example of Adams and Jefferson!

Q What do you think about American ignorance?

A America is founded on an ideal not a tribe. It is vitally important that we preserve the idea. The idea is found in three main documents, the Declaration of Independence, The Consititution and the Ghetty’s Burg Address. This is Winning our freedom, Ordering our freedom and Keeping our freedom. If allowed to split into tribes America wouldn’t make it. It may take many generations but eventually the idea gets everyone who lives here.

Sent via BlackBerry from T-Mobile

Ian Says:

July 9th, 2007 at 2:19 am

Here is why the FairTax MUST replace the income tax. The FairTax is:

• SIMPLE, easy to understand

• EFFICIENT, inexpensive to comply with and doesn’t cause less-than-optimal business decisions for tax minimization purposes

• FAIR, loophole free and everyone pays their share

• LOW TAX RATE, achieved by broad base with no exclusions

• PREDICTABLE, doesn’t change, so financial planning is possible

• UNINTRUSIVE, doesn’t intrude into our personal affairs or limit our liberty

• VISIBLE, not hidden from the public in tax-inflated prices or otherwise

• PRODUCTIVE, rewards, rather than penalizes, work and productivity

Its benefits are as follows:

FOR INDIVIDUALS:

• No more tax on income – make as much as you wish

• You receive your full paycheck – no more deductions

• You pay the tax when you buy “at retail” – not “used”

• No more double taxation (e.g. like on current Capital Gains)

• Reduction of “pre-FairTaxed” retail prices by 20%-30%

• Adding back 29.9% FairTax maintains current price levels

• FairTax would constitute 23% portion of new prices

• Every household receives a monthly check, or “pre-bate”

• “Prebate” is “advance payback” for monthly consumption to poverty level

• FairTax’s “prebate” ensures progressivity, poverty protection

• Finally, citizens are knowledgeable of what their tax IS

• Elimination of “parasitic” Income Tax industry

• NO MORE IRS. NO MORE FILING OF TAX RETURNS by individuals

• Those possessing illicit forms of income will ALSO pay the FairTax

• Households have more disposable income to purchase goods

• Savings is bolstered with reduction of interest rates

FOR BUSINESSES:

• Corporate income and payroll taxes revoked under FairTax

• Business compensated for collecting tax at “cash register”

• No more tax-related lawyers, lobbyists on company payrolls

• No more embedded (hidden) income/payroll taxes in prices

• Reduced costs. Competition – not tax policy – drives prices

• Off-shore “tax haven” headquarters can now return to U.S

• No more “favors” from politicians at expense of taxpayers

• Resources go to R&D and study of competition – not taxes

• Marketplace distortions eliminated for fair competition

• US exports increase their share of foreign markets

FOR THE COUNTRY:

• 7% – 13% economic growth projected in the first year of the FairTax

• Jobs return to the U.S.

• Foreign corporations “set up shop” in the U.S.

• Tax system trends are corrected to “enlarge the pie”

• Larger economic “pie,” means thinner tax rate “slices”

• Initial 23% portion of price is pressured downward as “pie”

increases

• No more “closed door” tax deals by politicians and business

• FairTax sets new global standard. Other countries will follow

While many vested interests are motivated to demagog this well-researched plan, those who want to become part of the solution can start here: http://snipr.com/ftnow

Demand TRUE tax reform of your representatives in Congress: http://snipr.com/scrapthecode

While I certainly don’t agree with this posted advertisement. I decided to post it anyway as a means to provoke further thought on the issue. I personally do not endorse or support the claims of this post.

-John Keller